Recent Storm Damage Posts

3 Tips To make handling a Canceled Flight Easier

7/13/2022 (Permalink)

No one enjoys a canceled flight, but it can be wise to prepare just in case

No one enjoys a canceled flight, but it can be wise to prepare just in case

Things You Can Do If a Storm Causes a Delayed or Canceled Flight

Whether you're leaving your home in Bothell, WA, to travel for work or for leisure, an issue with your flight can be frustrating. However, there are several things you can do to keep calm and comfortable if a storm causes a delayed or canceled flight.

1. Strategically Pack Your Carry-On

What you pack in your carry-on can make a big difference if your flight is delayed or canceled. Bringing extra clothes can ensure that you're comfortable wherever you go, and keeping your toothbrush and toothpaste with you can help you to feel refreshed. It's also generally useful to bring along something to keep you entertained while you wait at a hotel or at the airport, such as a book, your phone, or crossword puzzles.

2. Ask Your Airline About Compensation

Though every airline has different policies, it's often helpful to inquire about your airline's compensation policy if your flight is delayed or canceled. Some airlines will cover the cost of connecting flights or will offer a voucher for a hotel, taxi, or food. Even if you don't receive compensation for your delayed or canceled flight, it's often useful to contact the airline in order to receive help rebooking your ticket.

3. Ask a Friend or Family Member To Check On Your House

After a storm causes an issue with your flight, the last thing you'll want is to come home to a house that has sustained storm damage. Though emergency restoration services can often assist in mitigation and restoration efforts, it's usually preferable to prevent damage, to begin with. When it comes to storm tips and preparing for a trip, you can often prevent major problems by asking someone you trust to check on your house to make sure everything is okay when you're gone.

No one enjoys a delayed or canceled flight, but it can be wise to prepare just in case you find yourself waiting in an airport or staying an extra night away from home. Strategically packing your carry-on bag, asking about compensation, and asking someone to check on your home while you're away can help you to handle a canceled or delayed flight like a pro.

What To Know About Storm Water Damage Cleanup

6/14/2022 (Permalink)

There are three categories of damage due to water.

There are three categories of damage due to water.

What You Should Know About Storm Water Cleanup

Homeowners know that they’re responsible for taking care of property needs, including repairs and cleanups. This includes damage due to water, which can range from an overflowing sink to flooding from a storm event. If you ever experience this type of damage in your home in Shoreline, WA, you should contact a provider of damage restoration services for cleanup and full repair. That said, not every type of damage is the same, especially when it comes to cleaning.

Understanding Water Damage Categories

There are three categories of damage due to water:

- Category 1: Also known as clean water, this includes damage from a broken pipe or overflowing water without contaminants.

- Category 2: Sometimes called grey water, this category refers to damage from water that contains contaminants, such as discharge from a dishwasher or washing machine.

- Category 3: Damage in this category comes from flooding, rising groundwater, sewage backup, or seawater. Also known as black water, category 3 water is the most severe, containing unsanitary agents.

Water in categories 1 and 2 can become categories 2 and 3 respectively if left unattended.

Cleaning Up Damage

Cleanup should be handled by a professional, especially flood damage, which often involves unsanitary agents, pathogens, and toxins. It’s important that the actual destruction be correctly assessed and the proper remediation techniques are employed. This includes disinfection, advanced cleaning, removal of items, drying methods, and ventilation. What might look like a certain level of damage to you may be worse after professional evaluation.

While you never hope to have flooding in your home in Shoreline, WA it’s important to recognize the gravity of the situation. No two situations are the same, so it’s crucial to hire a pro to make a professional assessment. They’ll understand the key differences between the types of water damage and how to restore your place to pre-damage conditions as quickly and as efficiently as possible.

Understanding Commercial Storm Insurance

4/13/2022 (Permalink)

High winds, heavy rains, and other effects can damage your building and contents inside your Bothell, WA home.

High winds, heavy rains, and other effects can damage your building and contents inside your Bothell, WA home.

Commercial Storm Insurance Explained

Bad weather isn't unheard of in Bothell, WA . You can't often anticipate a major storm, but there are ways you can be prepared. High winds, heavy rains, and other effects can damage your building and contents inside. Storm insurance should be an essential piece of your business, as it can protect you and your investment. It's important to know how it works and what it covers.

What General Property Insurance Covers

You are no doubt familiar with property insurance and have a policy for your business property. However, this plan will not cover all types of damage you'd encounter from a storm. It will help repair damage from the following:

- Damage from hail and wind

- Damage from tornadoes

- Water damage from broken pipes or a leaky roof

Covering the Rest

You may wonder what happens with other types of flooding if your normal insurance policy won't cover cleanup and repair costs. Storm insurance is supplemental and takes care of water damage that results from overflowing waterways, sewer backups, or broken sewer lines. This coverage will also come in handy if torrential rainfall causes water to gather near the foundation of the building that then finds its way inside.

Filing a Claim

It's always best to file a claim as soon after the incident as possible. Insurance coverage is there to give you peace of mind and help you to rebuild. But the longer you wait to make a claim, the more difficult it will be to go through the process. Call your agent and describe what happened and what was damaged. It's best to include pictures of the affected area and a list of items that were lost.

Once you file a storm insurance claim, your agent will coordinate with professional cleanup crews to assess the situation and begin cleanup and rebuilding efforts. If you don't have supplemental flood coverage, purchase a policy today.

Prepare Your Commercial Property for a Storm

3/30/2022 (Permalink)

Storms can wreak havoc on commercial structures. You can reduce the risk of damage to your property by implementing strong storm preparedness plans.

Storms can wreak havoc on commercial structures. You can reduce the risk of damage to your property by implementing strong storm preparedness plans.

Storm-Proof Your Commercial Property

Storms can wreak havoc on commercial buildings. By implementing some sound storm preparedness plans you can reduce the risk of severe damage to your property in Shoreline, WA.

1. Mitigate the Risks

Strong winds and heavy rain account for much of the damage during a storm. Before the storm hits, prepare your property to reduce the risk of extensive damage.

Bring in outdoor equipment, such as grills and lawn furniture to avoid items becoming airborne. Board up windows and glass doors so they don't shatter during the storm.

Inspect roofing materials to ensure they are secured. Fix any loose materials right away.

Trim any loose branches near the building so they don't damage the siding or break windows.

Disconnect computers and other electrical devices. Don't unplug the refrigerator, however.

Move loose items away from windows inside the building as much as possible.

2. Train Employees on Storm Procedures

Make sure all employees and visitors understand what to do in an emergency. Property management must develop work instructions to address the risks and then train workers on the procedures.

Conduct emergency drills with all employees so that they are familiar with the storm preparedness procedures. This will reduce the risk of people becoming panicked during a true emergency.

Designate evacuation exits and assign persons who are responsible to account for employees and visitors.

3. Inspect the Property After the Storm Passes

Wait until you are sure that the storm has passed before inspecting the building. If the emergency required persons to evacuate, don't allow employees to enter the building until authorities have given permission to do so.

Authorized personnel should inspect the property around the building to look for damage. They can identify issues to the structural integrity of the building and look for potential hazards that must be addressed. Call a storm restoration service if you need help with repairs.

Implement a sound storm preparedness plan to reduce the risk of damage during a storm.

How To Protect Your Business From Rain Damage

3/30/2022 (Permalink)

Keeping the structure in good repair prevents weak spots that are vulnerable to strong winds and heavy rains.

Keeping the structure in good repair prevents weak spots that are vulnerable to strong winds and heavy rains.

How To Prevent Rain Damage To Your Business

Rain damage to your Lake Forest Park, WA, business can be a major problem but is often preventable. By maintaining the structural integrity of your building’s exterior, you can minimize potential damage from rain and storms.

Prevention

When it comes to protecting your commercial building from storm damage, routine maintenance is key. Keeping the structure in good repair prevents weak spots that are vulnerable to strong winds and heavy rains. All buildings have an envelope, the barrier between the inside and outdoors. The building envelope has several components, including:

- Roof

- Foundation

- Walls

- Windows

- Doors

- Seals

Have the entire building envelope inspected at least once a year and address any problems quickly. Your contractor can let you know if you need more frequent inspections.

In addition to structural issues, be sure to watch out for landscaping dangers as well. Keep limbs trimmed and make sure sick or weak trees are cleared from the property.

Cleanup

Even properly maintained buildings can suffer storm and rain damage. Fortunately, quick action can prevent further problems. If water inundates your building, the first step after ensuring everyone is safe is removing the standing water and remaining moisture. If possible, dry the property out within 24 hours to prevent black mold and other fungal growth.

After the property is dry, it should be thoroughly cleaned. Flood water often harbors bacteria and other contaminants that can linger even after the water has been removed. A certified restoration service has the knowledge to select the best cleaning product and technique for every affected item and let you know which items should be replaced rather than restored. After everything is dry and sanitized, damaged items can be repaired.

The weather at your business site may be unpleasant or unpredictable, but there are ways you can protect your commercial property from storm and rain damage. Perform routine inspections, keep the building envelope in good repair and clean up any water damage as soon as possible to prevent mold growth.

The Two Keys To Avoiding Winter Storm Damage

11/19/2021 (Permalink)

Regular maintenance can prevent winter storm damage, if you need help to know how you can do it, call SERVPRO.

Regular maintenance can prevent winter storm damage, if you need help to know how you can do it, call SERVPRO.

The Two Crucial Steps to Avoiding Winter Storm Damage

When the weather outside in Woodinville, WA, is not delightful, you’ll be glad you prepared for the latest winter storm. You can prevent storm damage at your business with regular maintenance and minimize any unexpected effects with basic preparation. Even with a pipe break, maintenance and preparation will help you get back to business sooner than you think.

Avoiding Damage Starts With Smart Maintenance

Regular maintenance can prevent winter storm damage. Pay particular attention to these areas:

- Roof - Make sure the roof is leak-free. As water freezes it expands, so a small drip can create a bigger problem. Take care of it before that happens.

- Insulation - Be aware of any cracks in the walls or around doors and windows. Freezing air sneaking into walls can freeze pipes. Good insulation can help prevent burst pipes.

- Landscaping - Look at the trees around your building. Sick trees will be more likely to crack and fall. Removing those trees and overhanging branches now will save you from having to remove them from a broken window later.

Minimizing Recovery Takes Preparation

When the storm is on its way, taking steps to prepare will minimize any necessary post-storm work before you get back to business as usual. Protecting the things essential to your business is key.

• What are the most valuable tools and items in your business? Elevate them off the floor and cover with a tarp or plastic sheet. This will help keep those items dry in case off a pipe break or flooding.

• Where are your most important documents? Store printed documents in a waterproof container such a specially purchased safe. If they are electronic, store backup copies on a remote cloud or on a device you can place somewhere secure and dry.

• Where is your critical information? Keep contact information for emergency services, restoration professionals, business partners, employees and clients somewhere you can easily find it. You’ll be able to reach out to the people you need quickly.

You can minimize the stress of a winter storm with regular maintenance and a bit of preparation. By preventing damage and protecting your business, you can speed up the return to normal.

Are You Covered for Storm Damage?

10/4/2021 (Permalink)

Make sure your home is covered from storm damage.

Make sure your home is covered from storm damage.

Are You Protected Against Storm Damage?

Does your homeowner’s policy cover potential damages from flooding, or do you need dedicated flood insurance? While your average policy may cover you in the event of high winds causing broken windows and roof damage, the number of insurers covering natural floods on typical homeowner’s policies is few and far between, meaning that storm damages caused by a natural flood are not protected against. Therefore, before making a flood claim or choosing a more specific policy, it is necessary to understand storm damages.

Basic Weather Losses

The way insurers protect people and their property is by putting together universal policies, which means that they present standard homeowners policies that cover weather events that most of the population experience. Therefore, an insurance claim on a standard policy for wind damage will probably be accepted while property loss caused by a flood typically won't be. To understand this level of decision-making, consider standard homeowner plans as coverage for basic weather losses, like wind.

Rare Weather Losses

A flood claim is not standard, and therefore, it requires a special policy. While there are parts of the country that experience annual flooding, most of the country does not, making this weather phenomena rare in the eyes of insurance providers.

While policies will inevitably change, one thing remains the same: the need for emergency remediation services in the Woodinville, WA, area. Whether or not you have adequate insurance, you will need the help of qualified professionals to restore your property after a disaster strikes.

Granted, insurance helps to reduce the costs of restoration, but it is needed regardless of coverage. With the proper coverage, a flood claim does not have to be complicated. However, if you do not have flood insurance, then an insurer will likely pick your claim apart to reduce their liability. If you are concerned about potential flooding, then contact your insurance company and make sure you are covered.

Flood Hazards for First Responders

7/28/2021 (Permalink)

Mold after storm damage

Mold after storm damage

First Responders' Flood Risks

When a flood hits The Highlands, WA, a first responder is the hero of the day as he or she works to protect lives, property and the environment. It is important for these trained professionals to look after themselves as well, and this work comes with its own set of potential risks. Rather than put yourself or others at risk, follow these simple steps to stay safe.

Safety Checklist

Flood response has its own set of hazards. Prior to heading out to help others, take time to review personal safety procedures.

• Immunizations for Hepatitis B and tetanus must be up-to-date.

• Protective clothing should include chemical-resistant outer clothing, goggles, boots and plastic or rubber gloves.

• Layer latex gloves over puncture-resistant gloves and discard them after use.

Other Precautions

After cleaning, don’t wear contaminated clothes in your personal vehicle. Remember to shower and change into uncontaminated clothes when your shift as a first responder ends. Wear a disposable N95 mask to protect yourself from inhaling mold. Clean wet surfaces with clean water and disinfectant. Properly vent portable generators and avoid the risk of electrocution.

More Protections

Be aware of your surroundings, especially when working near traffic. Watch for sinkholes and areas where the terrain has sustained damage. Seek medical care if you are exposed to raw sewage or chemicals. Frequently wash your hands in soap and clean water or with alcohol-based gel, especially before meals and after handling potentially contaminated materials.

The major cause of loss of life in floods is being trapped in a vehicle. It takes only a foot of water to float many cars and trucks, and once the wheels are off the road, rolling, flipping, or colliding with anything downstream can happen quickly.

A first responder is a welcome sight to flood victims and is the person who will lead the way to recovery and damage remediation. Though staying dry may be impossible, staying safe doesn’t have to be.

Sump Pump Maintenance

6/24/2021 (Permalink)

A sump pump can be very effective at keeping your Richmond Beach, WA, basement, or crawlspace from overflowing.

A sump pump can be very effective at keeping your Richmond Beach, WA, basement, or crawlspace from overflowing.

Sump Pump Maintenance

A sump pump can be very effective at keeping your Richmond Beach, WA, basement, or crawlspace from overflowing. However, they are usually not in the living areas of the home and are frequently forgotten about until they stop working. Fortunately, maintaining the pump is generally pretty easy.

Cleaning

An important part of pump maintenance is keeping the pump clean. The following parts should be checked regularly for debris:

- vent

- pipes

- intake screen

- sump pit

In addition to checking these areas routinely, it is a good idea to take the pump out of the sump pit once a year and do a thorough cleaning of both the pump and the pit.

Testing

In addition to keeping the sump pump clean, it is important to test it. To do this, pour a bucket of water into the sump pit and make sure the pump activates and drains the water properly. Additionally, check that the power cord is free of damage and that the outlet is working. These pumps are usually connected to ground fault circuit interrupter (GFCI) outlets, and sometimes those types of outlets turn off. If the pump has a backup battery, be sure to test them routinely and change them as directed by the manufacturer.

Other Maintenance Tasks

There are a few other things to watch for when examining your pump. Make sure the pump is upright in the sump pit. Look for rust and other signs of corrosion. Check that the float ball can move freely. If you are uncomfortable performing any part of the pump maintenance yourself, find a reliable contractor to perform the inspections and maintenance for you.

Even a well-maintained sump pump can malfunction, leaving you with a flooded basement or crawlspace that can lead to further complications, such as mold damage. Fortunately, a certified restoration service can help you get your home back to normal quickly and safely.

Preparing Your Business' Exterior for a Storm: 3 Steps

6/1/2021 (Permalink)

Protect your building from high winds by boarding them.

Protect your building from high winds by boarding them.

Steps To Lower The Impact Of A Strong Storm

When a serious storm is set to bear down on your Kenmore, WA, business, preparedness can help you protect your investment. One of the most important actions you can take is to inspect the exterior of your business with the help of a storm damage and restoration company, as their advice for exterior maintenance can help guide you through a few steps that may lower the impact of a strong storm.

1. Schedule a Building Inspection

Storm damage technicians can help you identify some exterior areas of your building that are most likely to take on damage., They may inspect the roof to gauge whether any existing damage might be made worse by a storm and whether any exterior doors may be too weak to withstand powerful winds. Covering these areas during bad weather may protect them until you can examine repair or replacement options.

2. Address Your Concerns

Once a building inspection is complete, discuss your concerns with a storm damage restoration team. They can help you understand whether your worries are legitimate and if you may have overlooked other areas that may need attention. For example, if your storefront features large display windows, you may want to ask your technicians about protecting them from high winds and blowing debris with sturdy wooden boards.

3. Implement Protection Actions

Your storm damage remediation and restoration service can help you decide what kind of exterior maintenance would best protect your building and then take steps to implement it. They may strengthen exterior exits, place protective material over windows and cover skylights to protect them from leaks. They can also advise you about keeping your building maintained properly, as this may reduce the risk of storm damage.

When powerful storms arrive in Kenmore, WA, they can pose a serious risk to your commercial building. Performing regular exterior maintenance, as well as working with a restoration service, can help you protect your business and prevent costly repairs.

The Right Way To Restore Water Damage After a Roof Leak

4/9/2021 (Permalink)

Mold after storm damage.

Mold after storm damage.

Water Damage Restoration

Water damage to your commercial building in Bothell, WA, comes in many shapes and forms, from minor water leaks to true catastrophes. A roof leak is one of the more common avenues whereby water penetrates your building envelope. As with everything, there is a right way and a less effective way to handle incoming water from your roof system. A trained and experienced storm mitigation franchise in your area is likely to have this scenario down to an efficient process.

First Things First

An experienced crew will arrive quickly at your property and do a fast inspection and assessment of the entire situation. They will then develop a plan to deal with the roof leak and other concerns. They will prioritize what should be done first, focusing on the following concerns:

- The safety of all employees and customers

- The presence of standing water

- The repair of the damaged roof

- The removal of water with wet vacuums

- The drying out of wet areas

By following an orderly process, technicians will complete the most important jobs first. This is done to limit damages and to prevent additional damages.

Last Things Last

When the situation is under control, the technicians will make sure things are in place for a successful restoration of your building. They will replace missing shingles on the roof if necessary. Workers will use safe and effective cleaning agents to wipe down surfaces and remove unhealthy residues caused by the incoming water. Wet materials will be thrown out, and the restoration of damaged drywall and other structures will be completed. They will make sure all odors have been addressed, and that no moist areas remain to allow for mold growth. The roof leak will be closed so that any subsequent storms will not result in water damage. An orderly process by restoration professionals is the smart way to beat any form of storm damage.

Flooded Home in Stanwood

3/24/2021 (Permalink)

Here at SERVPRO of Seattle Northwest - SERVPRO of Shoreline/Woodinville we work closely with other SERVPRO franchise's when the need arises. We received a call from our close friends from SERVPRO of Skagit County to assist a family with a devastating water loss they had to their home while they were away on vacation. A bathroom sink had sprung a leak on the top floor of their home, flooding almost every room in their house.

We worked tirelessly in conjunction with SERVPRO of Skagit County and the customers insurance to ensure that all their needs were met in a timely and professional matter. The project went smooth and the customer was completely satisfied with the results. One of the most satisfying parts of our job is bringing happiness back to a family that has lost so much.

Prepairing for the Rain

3/21/2021 (Permalink)

Your Shoreline home's gutters help catch rainfall and ensure that it stays far away from the foundation of your home. However, they can't effectively perform their job if they're clogged with ice or debris that piled up over the course of the seasons. Clean gutters by spraying a hose through them from the bottom up. You can also use a trowel to scoop out anything that's clogging your gutters, or purchase a cleaning tool specifically designed for your gutters and attach it to your hose.

Before the rainy season begins, it's crucial that you check your home for signs of leakage. It's best to fix a leak early on, as leaving it to worsen could result in flooding, mold and mildew, and even collapsed ceilings. Scan your ceilings for water marks and look for peeling paint. You should also venture outside of your home and look at your roof for telltale signs. Check out the ridges and see if there are any cracks. Look for loose, curled or missing shingles, which can signal roof damage and allow water to enter the home.

Top 6 Ways to Protect Your Home From Wind Damage

3/16/2021 (Permalink)

Top 6 Ways To Protect Your Home From Wind Damage In the Seattle Northwest

Wind storms can be very damaging to your home or property if you are not prepared. Unfortunately, we rarely get much warning before a large wind storm so it is critical to prepare your home ahead of time. Routinely checking, fixing or updating areas around your Shoreline home can make the difference between a hundred dollars and thousands of dollars in damages.

Here are six ways to prepare your home before the next storm hits Seattle:

- Is your roof in good shape?

- Your shingles should be nailed down properly and all secured together.

- Replace any missing shingles immediately.

- Make sure your garage door is secure.

- Sometimes this means hiring a company to inspect your garage door to ensure it is properly secured and functioning well.

- Secure all outdoor items.

- Grills, patio furniture, trampolines, etc. These items can cause a lot of damage if the wind is strong enough to pick them up.

- Ensure your gutters are properly secured and clean them out regularly.

- Clogged cutters can create water damage to your house. They are also more likely to break in a high wind storm if they are weakened by heavy debris.

- Are your windows storm proof?

- Installing storm proof windows can make a big difference in protecting your home from high winds and hail from a storm.

- If you don’t have storm proof windows, consider installing steel or aluminum shutters on your windows or sliding doors to protect them from flying debris.

- Remove or trim/maintain trees around your home.

- Trimming your trees of dead wood can help prevent large branches falling during a wind storm.

Be sure to routinely check and maintain your home so you are ready before the next storm hits the north west. However, if you do find yourself in need of help after a storm, call SERVPRO of Seattle Northwest. We specialize in restoration and water damage repair in the Seattle Northwest area. Call us after a storm and let us take the stress off of your family! We will make sure it's "Like it never even happened."

Important Things To Know About Commercial Flood Insurance

3/30/2020 (Permalink)

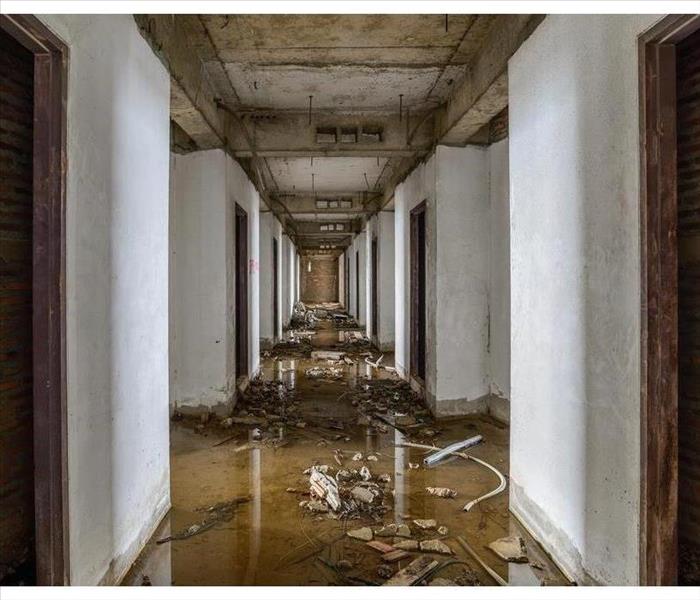

Flooded building in Kenmore, WA

Flooded building in Kenmore, WA

You might not be aware that your commercial property insurance policy does not typically cover damage from a flood. The truth is, you need a special policy to get flood insurance, and this is administered by and available through the federal government's National Flood Insurance Program. You do not buy directly through the NFIP, but go through an insurance agent to purchase this policy. (Some private insurers do provide flood insurance, though this is a less common source.) In many situations, you are not required to have insurance that covers flooding, but some situations make it mandatory. This is the case if your commercial property is in a flood zone and you have a mortgage with a federally insured lender.

More Facts on Flood Insurance

This type of policy covers damage to your buildings and its content in the case of a flood. A flood is defined in the following language:

- Waters must cover at least two acres or affect at least two properties

- The water must come from below

- The water or mud comes from overflowing rivers, storm surges, melting snow or ice

Other common flooding scenarios include broken dams or levees or faulty storm drain systems. Such things as damaged septic systems away from your building and landscape damage will not be covered, nor will destruction of company vehicles. Your regular commercial insurance policy should cover damages from roof leaks, lightning, hail and ice dams.

Additional Information

A 30-day waiting period applies to new flood insurance policies. The policy is capped at $500,000 per building and $500,000 for its contents. As a business owner in Kenmore, WA, you can take other steps to protect your company from flooding. Preparation and planning can reduce your vulnerability to a storm. Partnering with a local storm remediation team that can be on site fast could reduce any business interruption your company faces. A fast cleanup and recovery by professionals could help your company survive a flood.

Everything You Need To Know About Commercial Flood Insurance

1/6/2020 (Permalink)

Commercial flood insurance can protect your Richmond Highlands, WA, business following storm damage

Commercial flood insurance can protect your Richmond Highlands, WA, business following storm damage

If you own a business that is affected by a hurricane or heavy rain, you may have to spend some of your profits on repairs. Thankfully, commercial flood insurance is available to help you pay for the cost of storm cleanup and restoration services. Below is more information on this type of insurance.

What Is Covered by a Flood Policy?

This type of insurance covers flood damage that affects multiple properties or acres. Typical causes of flooding include:

- Storm surge

- Snow melt

- Blocked storm drains

- Broken levees or dams

- Overflowing streams and rivers

- Prolonged or heavy rain

A flood policy also usually covers mold growth, though there are exceptions. Your insurer may deny your claim if you failed to take steps to mitigate the damage.

What Is Not Covered by a Flood Policy?

Any areas outside your property, including septic systems and landscaping, are not covered by a flood policy. A typical policy also excludes business interruption costs and company vehicles.

How Do You Get a Flood Policy?

Your typical commercial insurance policy likely does not include flood coverage. However, you can purchase a separate policy from the National Flood Insurance Program. Simply contact an insurance professional who is familiar with NFIP policies.

How Much Coverage Do You Get?

A commercial flood policy usually includes $500,000 for the structure and $500,000 for the items inside it. If you are worried about more severe damage to your business, you can buy additional coverage.

Who Needs a Flood Policy?

Depending on where your business is located, you may be legally required to purchase a flood policy. Specifically, those who own a company in a flood-prone area must buy this type of insurance in order to obtain a mortgage from an insured or federally regulated lender.

Commercial flood insurance can protect your Richmond Highlands, WA, business following storm damage. While it may cost you extra money now, it could save you from spending money on expensive flood cleanup in the long run.

Gain a Better Understanding of Commercial Storm Coverage

10/24/2019 (Permalink)

Hurricanes and major wind events cause major loss of life and extensive damages nearly every year

Hurricanes and major wind events cause major loss of life and extensive damages nearly every year

The terminology of storm insurance coverage is one key to better understanding your policy. It follows the pattern of other insurances, but at times it has its own vocabulary. For example, storm coverage makes use of deductibles, but recently the industry has moved toward percentage deductibles instead of fixed deductibles. This means the deductible is based upon a percentage of the insured value of the property instead of a fixed dollar amount which is more common in auto policies. This limits an insurer's exposure to catastrophic losses should a big event like Hurricane Katrina hit an area.

A Definition of Key Terms

Knowing the language of insurance coverage is one path to understanding. Here are some terms that may be in your storm insurance policy:

Mandatory Deductibles are determined by insurance rules, regulators or state law, or by the insurer

A Market Assistance Plan is a referral system that connects companies looking for insurance in touch with insurance companies looking for more business

Optional Deductibles allow policy holders in less vulnerable areas to pay higher deductibles in return for lower premiums

A Trigger is an event where a hurricane deductible is applied

Coverage for a major storm in Shoreline, WA, is subject to the language of your policy. A better understanding of your insurance coverage allows you to make changes and adjustments that protect your company's assets while keeping premiums affordable.

A Plan for Protection

Hurricanes and major wind events cause major loss of life and extensive damages nearly every year. A business needs to protect itself with a comprehensive disaster plan. Mitigating losses after a storm hits should be part of the plan. Working with a storm damage remediation company that is Faster to Any Size Disaster in Shoreline, WA, is an important step. Fast cleanup and water removal will reduce losses. Knowledge of your storm insurance will result in a better policy.

Risks of Driving Through Flooded Streets

9/13/2019 (Permalink)

Never drive through a flooded roadway

Never drive through a flooded roadway

Be Aware of The Dangers of a Flooded Street

Flooding can do major damage. Not only to your home and vehicle but your life as well. Be aware of the dangers of a flooded street in Richmond Beach, WA, and get out of the area safely.

Risk to Your Life

You take your life and the lives of others into your hands if you decide to venture out into a flooded street. Police will put barricades on highways to prevent drivers from heading into potentially dangerous flooded roads. Do not go around the barriers. Deciding to go around a roadblock puts you in danger of being swept away and drowning. You may also put first responders at risk if you need saving.

Risk to Your Vehicle

Water can do a lot of damage if it gets into your vehicle. It can get into the electrical circuits and cause a computer system failure. The failure, in turn, can affect the airbags and brakes. The more water in the vehicle, the more likely your vehicle can become a total loss. Don’t drive on a flooded street.

6 inches of water can cause the tire to lose traction. Twelve inches of rain can cause the car to float. 2 feet of water will carry away most vehicles, including trucks and SUVs.

Risk to Your Money

Different government agencies give warnings about flooded roads to keep you and your loved ones safe. These warnings can also save you money. Keep your money in your pocketbook by heeding caution signs.

Damage to your vehicle causes your car insurance to increase, not to mention the possibility of having to buy a new car if yours is considered a total loss. Paying the hospital bills after being injured can pile up.

Turn around, don’t drown. Pay attention to travel tips for the best routes to take if you need to get out. Turn on your local radio or television stations for recent updates or go to the social media pages of the emergency management agency in your area. Also speaking with a damage restoration specialist can give you more ideas about how to protect your property from flooding.

What to Expect After the Storm

8/30/2019 (Permalink)

Flooding damage in Kenmore, WA

Flooding damage in Kenmore, WA

When a storm happens in Kenmore, WA, hopefully your business can come through it with minimal damage. If flooding or heavy rains were involved and your business was highly impacted, issues need to be addressed immediately to ensure the damage doesn’t spread. This often means being prepared to tear out affected areas.

Water Is Water, Right?

Water damage in any form is sneaky. Even a slow leak can turn into mold breeding grounds and spread. Flooding or heavy rains can create the same problems and bring a few of its own. The difference between a simple leak and a flood leak is in the water itself.

Clean water – Typically the most common type of water damage, it is easy to clean and includes rain, condensation and water from leaky pipes.

Gray water – This type has some contaminants and comes from dishwashers, toilets and washing machines.

Black water – Floods and severe rain can accumulate debris and contaminated water, including sewage.

Dry, Remove, Replace

After flooding or rain subsides, it is necessary to tear out any materials that are damaged. The first step is dry the wet area. Getting the moisture out will reduce the risk of mold forming. Whether it’s carpet, wood or other materials, anything porous can be a welcoming locale for mold to grow.

Once the damaged areas are gone, a thorough cleaning is needed. This will also help in discovering if there was more damage than was initially thought. Local storm restoration professionals are the best bet to ensure it is properly disinfected. Lastly, it will be time to replace the affected areas. This may include drywall, flooring, carpeting and possibly even exterior siding.

While having to tear out parts of your building may be an unpleasant task, it’s vital to get your business back up and running after the storm. Taking the proper steps now will help you avoid problems down the road.

24/7 Emergency Service

24/7 Emergency Service