Important Things To Know About Commercial Flood Insurance

3/30/2020 (Permalink)

You might not be aware that your commercial property insurance policy does not typically cover damage from a flood. The truth is, you need a special policy to get flood insurance, and this is administered by and available through the federal government's National Flood Insurance Program. You do not buy directly through the NFIP, but go through an insurance agent to purchase this policy. (Some private insurers do provide flood insurance, though this is a less common source.) In many situations, you are not required to have insurance that covers flooding, but some situations make it mandatory. This is the case if your commercial property is in a flood zone and you have a mortgage with a federally insured lender.

More Facts on Flood Insurance

This type of policy covers damage to your buildings and its content in the case of a flood. A flood is defined in the following language:

- Waters must cover at least two acres or affect at least two properties

- The water must come from below

- The water or mud comes from overflowing rivers, storm surges, melting snow or ice

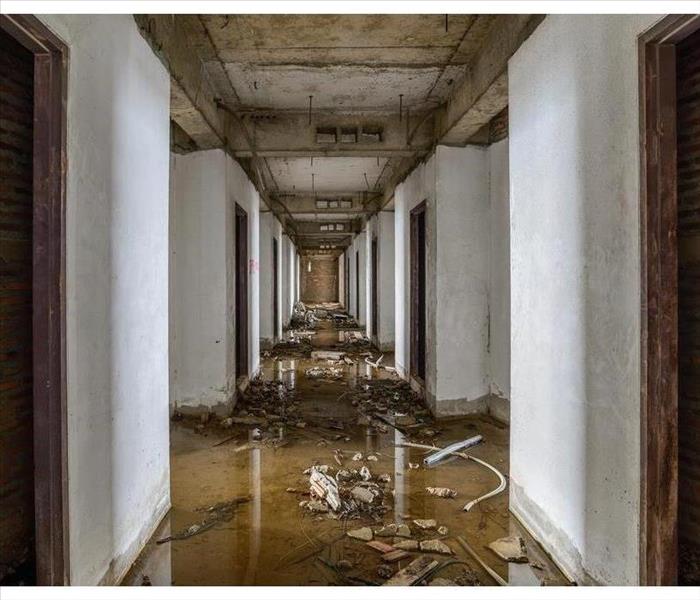

Other common flooding scenarios include broken dams or levees or faulty storm drain systems. Such things as damaged septic systems away from your building and landscape damage will not be covered, nor will destruction of company vehicles. Your regular commercial insurance policy should cover damages from roof leaks, lightning, hail and ice dams.

Additional Information

A 30-day waiting period applies to new flood insurance policies. The policy is capped at $500,000 per building and $500,000 for its contents. As a business owner in Kenmore, WA, you can take other steps to protect your company from flooding. Preparation and planning can reduce your vulnerability to a storm. Partnering with a local storm remediation team that can be on site fast could reduce any business interruption your company faces. A fast cleanup and recovery by professionals could help your company survive a flood.

24/7 Emergency Service

24/7 Emergency Service